Top 5 Pet Insurance Companies Recommended by Most Popular Websites

Top Pet Insurance Companies for Comprehensive Coverage: by Most Popular Websites Recommendations

Finding the right pet insurance can be a daunting task, but with so many options available, it’s important to find one that offers comprehensive coverage. In this article, we will be exploring the top pet insurance companies recommended by some of the most popular websites.

These recommendations are based on factors such as coverage options, customer service, and affordability. Whether you’re looking for protection for your furry friend or peace of mind from unexpected vet bills.

This article will provide you with the information you need to make an informed decision. So, get ready to find the best pet insurance option for your pet and keep them protected.

These 10 companies are consistently highly rated by Most Popular Websites for their coverage options, customer satisfaction, and financial stability.

1. Trupanion by NerdWallet

According to NerdWallet, the best pet insurance is Trupanion. It offers comprehensive coverage with no payout limits, a fast and easy claims process, and a wide range of coverage options.

NerdWallet’s Comprehensive Approach to Evaluating Pet Insurance Companies for Best Customer Experience

Established in the year 2000 and nestled in the heart of Seattle, Trupanion stands apart from its peers in the pet insurance industry. Unlike most insurers that require an annual deductible, Trupanion offers per-condition deductibles in the majority of states. Once the deductible is met, your pet will be entitled to lifelong coverage for that particular condition. Additionally, the company is currently experimenting with a zero-deductible plan in the state of Florida.

Trupanion also boasts several customer-centric features that set it apart from its competitors, such as its 24/7 preapproval hotline for any treatment doubts or concerns. Additionally, the company does not impose age-related premium hikes but adjusts premiums periodically based on local veterinary care costs for pets like yours.

It is worth noting that Trupanion is the preferred pet insurance provider for State Farm.

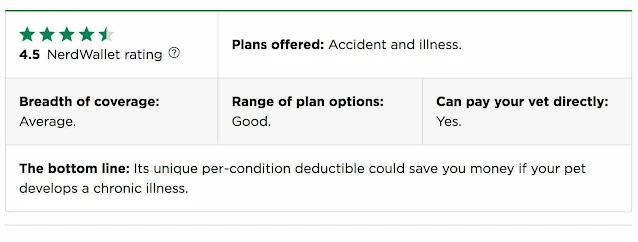

Trupanion NerdWallet Rating

The overall performance of Trupanion has been awarded a 4.5 out of 5-star rating by our editorial team at NerdWallet. Our evaluation process, which determines these ratings, takes into account a combination of factors such as the customer experience, the breadth of coverage options, and the financial stability of the company.

Trupanion pros and cons

Pros

- Unlimited annual and lifetime coverage for all pets.

- Per-condition deductibles could save you money if your pet develops a chronic illness.

- Doesn’t automatically raise premiums as your pet gets older.

Cons

- Exam fees aren’t covered.

- Coverage for rehab, acupuncture, and other complementary therapies costs extra in most states.

State Availability

Trupanion provides comprehensive pet insurance coverage across the United States and in Washington D.C., making their services accessible to pet owners in all 50 states.

Trupanion pet insurance plans

Trupanion offers a single accident and illness plan with unlimited payouts for every dog or cat. The company doesn’t sell wellness or accident-only plans.

What Trupanion pet insurance covers

Trupanion provides comprehensive coverage for a range of pet health needs, including illnesses, accidents, and surgeries. With no payout limits, policyholders can be assured their furry companions will receive the care they need without worrying about financial restrictions.

Trupanion pet insurance offers comprehensive coverage for a wide array of medical needs, including treatment, hospitalization, and surgical procedures for injuries and illnesses, including dreaded cancer. Diagnostic tests are also covered, as well as hereditary and congenital conditions. Essential prescription medications, food, and supplements procured through a veterinarian are also covered, along with prosthetic devices and carts for mobility assistance. The insurance extends to alternative therapies, such as herbal therapy, and even dental disease.

In the majority of regions across the country, you have the option to purchase supplementary coverage for your pet, including:

The Recovery and Complementary Care Rider offers a comprehensive coverage solution that encompasses a wide range of treatments, including physical rehabilitation, acupuncture, behavioral modification, chiropractic care, hydrotherapy, and homeopathic remedies. This addition to the standard plan ensures that your pet has access to the best possible care, regardless of the situation.

The Pet Owner Assistance Package offers comprehensive support during unforeseen circumstances, by providing coverage for non-medical expenses, such as boarding fees in case of hospitalization, offering a generous reward in case of pet loss, and covering the costs of cremation or burial services in the event of accidental death. With this package, pet owners can rest easy knowing that their furry friend is well taken care of, even in the toughest of times.

In Florida, the standard Trupanion plan provides a comprehensive coverage experience, elevating the bar of pet insurance expectations. With no added cost, pet owners are able to access premium services including rehabilitative therapy, chiropractic care, and hydrotherapy, ensuring their furry companion receives the highest quality of care possible.

What’s not covered

A Trupanion plan will not extend coverage for the following expenses:

- Exam fees for accidents or illnesses.

- Pre-existing conditions.

- Wellness and preventive care, including spay/neuter surgery, vaccinations and flea/tick medication.

- Routine dental care.

- Elective or cosmetic procedures such as declawing or tail docking.

- Conditions arising from racing or mistreatment.

Trupanion coverage options

Trupanion’s Deductible Structure: Unlike many other pet insurance providers that impose an annual deductible for all medical treatments incurred by your pet in a given year, Trupanion operates differently by implementing a per-condition deductible system across most states. This means that the deductible applies to each individual condition and once it is met, treatments for that specific condition will be covered for the remainder of your pet’s life.

In essence, the per-condition deductible provides a more personalized approach to pet insurance coverage, as it avoids the repeated payment of the deductible for ongoing treatments of a particular illness. However, it should be noted that in the event of multiple medical conditions, separate deductibles will be imposed for each.

For pet owners in Florida, Trupanion offers an even more favorable option, by eliminating deductibles altogether, providing them with comprehensive coverage without any out-of-pocket costs.

With Trupanion, pet owners in most states can enjoy 90% reimbursement on their veterinary expenses, meaning that after the deductible is met, only 10% of the bill remains to be covered by the pet owner. This generous reimbursement rate provides peace of mind to pet owners, knowing that their furry friend’s medical expenses are well taken care of.

For pet owners in Florida, there’s even more flexibility as they can choose their preferred reimbursement rate between 50% to 90%. This customization feature allows pet owners to balance their monthly premium costs with the level of reimbursement they desire.

One of the unique aspects of Trupanion’s coverage is the absence of annual, per-condition, or lifetime coverage limits. This means that pet owners can enjoy uninterrupted care for their pets without worrying about reaching a coverage limit. Regardless of the frequency or cost of veterinary treatments, Trupanion has got you covered.

Restrictions and waiting periods

Age restrictions: There’s no age restriction for enrolling pets in Trupanion insurance. Even older pets can be insured as long as they are under 14 years of age.

Waiting periods: Trupanion has a waiting period of 5 days for injury coverage to start and 30 days for illness coverage to become effective. This is the interval between purchasing the policy and when the coverage begins.

Discounts

Service animals may be eligible for a discount. However, this discount is not applicable to emotional support pets or service animals in the state of Washington.

Consumer experience

Website: Trupanion provides extensive information on its coverage and plans on its website, which includes a sample policy specific to your state. The website also enables you to get an instant quote, manage claims, make payments and update billing information efficiently.

App: The Trupanion app is user-friendly, offering features such as claim submissions and tracking, viewing of policy details, and the ability to earn rewards through friend referrals.

Claims: Trupanion offers flexible claims payment options, including direct payment to your vet or reimbursement for past payments. Claims can be submitted online, by email, mail, or fax, with the company processing over 50% within 24 hours. You can monitor the claim status through your online account and receive payment via direct deposit.

Customer service: Trupanion offers 24/7 customer support through phone (888-733-2685), email (info@Trupanion.com), or live chat.

Trupanion is a pet insurance company that provides comprehensive coverage for a range of pet health needs, including illnesses, accidents, and surgeries, with no payout limits.

It offers a single accident and illness plan with unlimited payouts for all dogs and cats across all 50 states in the US and Washington D.C. Policyholders can purchase supplementary coverage for physical rehabilitation, acupuncture, behavioral modification, chiropractic care, and homeopathic remedies.

Exam fees and pre-existing conditions are not covered. Trupanion operates with a per-condition deductible system, with 90% reimbursement in most states.

In Florida, deductibles are eliminated and reimbursement can be chosen between 50% to 90%. Trupanion doesn’t have annual, per-condition, or lifetime coverage limits. There are no age restrictions for enrolling pets in Trupanion insurance.

2. Petplan Forbes Recommendations

Forbes recently published a review on Petplan pet insurance and found that while the company has limited offerings, it stands out for its straightforward policy and excellent customer service.

Petplan also offers coverage options for hereditary and congenital conditions, which is uncommon in the pet insurance industry.

Policyholders appreciated the easy claims process and direct payment to vets. However, some customers wished for more extras like wellness coverage or a helpline.

Petplan has rebranded as Fetch by The Dodo. Check out our review on Fetch by The Dodo pet insurance.

Fetch by The Dodo has limited coverage options and services. Unlike other pet insurance companies, it doesn’t directly pay the vet for claims and has a longer waiting period for accidents. Additionally, it lacks wellness coverage and a helpline, compared to other pet insurance providers.

Petplan Pet Insurance Pros and Cons

Pros

- Covers vet exam fees

- Covers advertising fees and rewards if your pet is lost or stolen

- Includes coverage for boarding and kennel fees

Cons

- 15-day waiting period for accidents

- 6-month waiting period for pre-existing cruciate ligament issues and hip dysplasia (the pet may be covered if it’s within

- 30 days of your policy purchase and there’s documentation that it’s a new condition)

- No 24/7 vet helpline

- No preventative care plan is available

An Overview of the Benefits Offered by Petplan Pet Insurance

Petplan pet insurance covers a wide range of expenses including injuries, illnesses, dental issues, vet fees, therapy, surgery, and more. Additionally, it provides coverage for emergency care, lost or stolen pet expenses, and even vacation cancellation fees due to a sick pet.

Petplan pet insurance covers a wide range of expenses including:

- Injuries such as skin lacerations or fractured bones

- Illnesses such as urinary tract infections or vomiting

- Dental illnesses

- Vet exam fees

- Acupuncture

- Imaging and ultrasounds

- Diagnostic testing

- Hydrotherapy

- Surgery and rehabilitation

- Emergency care and hospitalizations

- Behavioral therapy

- Cancer treatment

- Chiropractic care

- Advertising and reward for lost or stolen pets

- Medically necessary boarding fees

- Vacation cancellation fees if you have to stay home due to a sick pet

Exclusions in Petplan Pet Insurance Coverage

Expenses Not Covered by Petplan Pet Insurance Policy:

- Pre-existing conditions

- Wellness and preventative care costs such as vaccinations or routine exams

- Costs arising from breeding, pregnancy, or nursing

- Experimental treatments

- Elective procedures such as tail docking, declawing, spaying, or neutering

- Food (including food prescribed by a veterinarian)

- Grooming

- Time and travel expenses to vet appointments

- Injuries or illnesses that arise out of racing, fighting, commercial guarding, or any occupational, professional or business use

Petplan Waiting Periods for Insurance Coverage

Petplan, like many pet insurance providers, imposes waiting periods before coverage starts for health-related expenses. These waiting periods, listed below, are a set time frame between enrolling in the insurance policy and when you can receive reimbursement for covered expenses.

- 15-day wait for accidents

- 15-day wait for illnesses

- Six-month wait for cruciate ligament, patella, and hip dysplasia issues.

Petplan’s 15-day waiting period for accidents is longer compared to other insurance providers like Embrace and Lemonade with 2-day waiting periods and Figo with a 1-day waiting period.

For illnesses, Petplan’s 15-day wait is one day longer than most pet insurance companies with 14-day waiting periods. If your pet has conditions like cruciate ligament and hip dysplasia, Petplan’s 6-month waiting period may be too long.

Consider alternatives like ASPCA, Many Pets, and Trupanion which don’t have waiting periods for these conditions.

Petplan Pet Insurance: Understanding Coverage Levels

Annual Limit Options: Petplan offers different annual limits on the maximum reimbursement amount for a given year. The options include:

- $5,000

- $15,000

- Unlimited

Petplan Deductible Options: The deductible is the amount you need to pay before your coverage starts for veterinary expenses. Petplan’s accident and illness plan offer the following deductible options:

- $250

- $300

- $500

Petplan Reimbursement Options: After paying for your pet’s veterinary expenses, you can claim reimbursement for eligible expenses under your policy. Petplan provides the following reimbursement choices:

- 70%

- 80%

- 90%

Petplan Pet Insurance provides coverage for a wide range of veterinary expenses, including injuries, illnesses, dental issues, vet fees, therapy, surgery, and more. Additionally, it covers emergency care, lost or stolen pet expenses, and vacation cancellation fees due to a sick pet.

However, it does not cover pre-existing conditions, wellness, or preventative care costs, experimental treatments, elective procedures, food, grooming, travel expenses, or injuries from racing or fighting.

Petplan has a 15-day waiting period for accidents and illnesses, and a 6-month waiting period for cruciate ligament, patella, and hip dysplasia issues.

It offers annual limit options of $5,000, $15,000, or unlimited, with deductible options of $250, $300, or $500, and reimbursement options of 70%, 80%, or 90%.

3. Nationwide Pet Insurance US News Recommendations

Nationwide ranks 7th in our 2023 Best Pet Insurance Companies list. Established in 1926, the company offers a range of insurance options, such as home, renters, car, and life insurance, as well as investment opportunities.

In 2009, Nationwide acquired the first-ever pet insurance company in the US, Veterinary Pet Insurance Company (established in 1982), and started offering pet insurance through employers or individually.

Today, National Casualty Company underwrites Nationwide’s insurance policies across the US, while in California it is underwritten by Veterinary Pet Insurance Company.

Nationwide Pet Insurance Pros and Cons

Nationwide Pet Insurance offers a range of insurance options and investment opportunities, but like any company, it has its advantages and disadvantages. Consider the pros and cons before making a decision.

Pros:

- Offers insurance coverage for exotic pets

- Doesn’t permanently exclude some pre-existing conditions

- Has wellness-only, illness/accident, and “whole pet” options

Cons:

- Premiums are on the higher end of companies in our rating

- Benefit limits will depend on which plan you purchase

- Pets must be under 10 years of age to enroll

Nationwide offers a comprehensive range of pet insurance coverage options, including the Pet Wellness plan that covers routine vaccinations and wellness exams, and the Major Medical plan which covers expenses for chronic conditions, surgeries, and hospitalization.

The Whole Pet plan offers even more extensive coverage for prescribed pet foods, supplements, and more. It’s Avian & Exotic Pet Plan is a unique offering, providing coverage for a variety of unusual pets such as hedgehogs, ferrets, and chinchillas.

Your benefit limits will vary based on the chosen plan, with the Whole Pet plan having an annual limit and Major Medical having an annual per condition or service limit.

Nationwide has a ten-year enrollment age limit but doesn’t permanently exclude pre-existing conditions if they have been considered cured for six months.

Nationwide offers a range of pet insurance choices. Pet owners can opt for wellness plan reimbursement, accident and illness coverage, or a comprehensive plan to cover various pet needs. They also cater to owners of exotic pets, providing insurance options for birds, reptiles, and other unconventional pets.

Plans Available from Nationwide

Nationwide provides multiple pet insurance options including Whole Pet, Major Medical, Pet Wellness, and Avian & Exotic Pets plans. The Whole Pet plan offers comprehensive coverage for injuries, illnesses, and routine care.

Pet Wellness plans cover routine needs like vaccinations, nail trimming, and more. The Major Medical plan insures against illnesses and injuries.

Nationwide is the only company in our 2023 rating that offers Avian & Exotic Pet coverage for a wide range of non-traditional pets, from reptiles to goats.

Nationwide offers additional coverage options for pet owners.

Nationwide offers various pet insurance plans, each with its own features, such as Whole Pet Wellness, Major Medical, Basic Wellness, and Avian and Exotic Pet. Plan customization depends on your selection. For instance, if you want a percentage reimbursement of veterinary costs, choose Whole Pet with Wellness. If you prefer a capped amount of reimbursement, opt for Major Medical.

How Much Does Nationwide Cost?

The cost of Nationwide Pet Insurance varies based on factors such as the type of plan selected, the location, the pet’s age, breed, and species, and the deductible amount chosen. It is essential to review the policy details and get a quote from the company to determine the exact cost of coverage.

- Whole Pet Wellness plan for a 1-year-old mixed-breed female dog: $56.74/month

- The premium for a 1-year-old male domestic shorthair cat: is $28.15/month

- Policy for animals living in Texas with a $250 annual deductible and $10,000 annual limit

- Higher premiums compared to other companies but include wellness coverage

- Premiums are based on a sample policy from Nationwide.

Nationwide’s pet insurance cost varies based on pet species, age, pre-existing conditions, and plan choice (e.g. Whole Pet Wellness). Cost can also be impacted by desired reimbursement rate. Nationwide offers multi-pet discounts and a group insurance discount through employer benefits. The prices listed are monthly premiums.

Nationwide Pet Insurance provides coverage options for pet owners including Whole Pet Wellness, Major Medical, Pet Wellness, and Avian & Exotic Pets plans.

The company is unique in offering coverage for a wide range of non-traditional pets, such as reptiles and birds. Policy cost varies based on factors such as pet species, age, and plan choice, with higher premiums, compared to other companies but includes wellness coverage.

Nationwide also offers discounts for multiple pets and group insurance through employer benefits. The policy’s exact cost can be determined by getting a quote from the company.

4. ASPCA Pet Health Insurance Investopedia Recommendations

ASPCA Pet Insurance offers accident/illness coverage starting with a base plan termed “Complete Coverage.” This is great news for pet owners who want to protect their furry friends from unexpected medical bills and vet visits.

The Complete Coverage plan includes protection against accidents, illnesses, hereditary and congenital conditions (like hip dysplasia), emergency care, cancer treatments, prescription medications, and more!

The best part about the Complete Coverage Plan is that it’s customizable to fit your budget – you can choose different annual limits on reimbursement amounts as well as different deductibles based on your needs.

Plus there’s an optional wellness add-on that covers routine preventative care like vaccinations or dental cleanings so you can keep up with regular checkups for your pet without breaking the bank.

At ASPCA Pet Insurance we understand how important our pets are in our lives – they’re family after all! That’s why we strive to provide comprehensive coverage at affordable prices so pet owners don’t have to worry when an illness or injury strikes unexpectedly – because no one should ever have to make tough decisions between their pocketbook and their beloved companion animal’s health!

ASPCA Pet Health Insurance provides comprehensive coverage for your furry friend’s medical needs. Whether it’s a routine checkup or a sudden illness, ASPCA has got you covered. With a range of plans to choose from, you can pick the coverage that best fits your pet’s needs and budget.aAAaaaaa

You can also get a personalized quote on the ASPCA website, making it easy to compare options and prices. ASPCA Pet Health Insurance is dedicated to ensuring that your pet receives the best possible care, and with its 24/7 veterinary support, you can always have peace of mind.

Don’t let unexpected veterinary bills catch you off guard, protect your pet with ASPCA Pet Health Insurance today.

ASPCA Pet Insurance Pros and Cons

Pros

- Covers cats, dogs, and horses: ASPCA offers coverage for horses in addition to cats and dogs, unlike many other pet insurance providers. This makes it an ideal option for pet owners who have horses, as veterinary care for horses can be expensive.

- Trusted name with years of experience: ASPCA Pet Insurance, previously known as Hartville Pet Insurance, has a long history of providing pet health insurance plans, dating back to 1997. This level of experience in the industry builds trust with pet owners and gives them peace of mind that their coverage will be available when needed.

- No maximum pet enrollment age: ASPCA Pet Insurance has no age limit for enrollment, making it an ideal option for pet owners with senior pets, unlike many other insurance companies that restrict coverage for older animals.

Cons

- No standalone wellness plan offered: To get routine veterinary care covered by ASPCA Pet Insurance, purchase an accident/illness plan first.

- Online enrollment is limited to a $10,000 annual limit: To have a higher coverage limit for serious illnesses or accidents, you need to call ASPCA Pet Insurance while enrolling and request a higher annual limit. The standard coverage may not be sufficient to cover expenses.

- No diminishing deductible: ASPCA does not reduce your deductible for going claim-free.

Plans Available

The different plans that ASPCA Pet Insurance has to offer. Whether you have a new puppy or an older pet, we have the perfect plan for your furry friend.

Complete Coverage can be customized with different deductibles, annual limits, and reimbursement levels. ASPCA also has an Accident-Only Plan which is lower cost and covers only veterinary care needed after an accident. And if preventive care is important to you then ASPCA also offers two levels of add-on wellness coverage (Basic & Prime) that help manage those costs too!

No matter what type of pet insurance needs you may need – from basic coverage all the way up to comprehensive protection – ASPCA Pet Insurance has got it covered for your beloved companion animal(s).

Waiting Periods

The Complete Care plan and the Accident-Only plan are two different health insurance plans offered by many companies. Both plans have a uniform waiting period of 14 days after enrollment for all covered services. During this time, the insured person is not eligible to receive any medical services or benefits from the plan.

However, the Wellness Plan has a shorter waiting period of 7 days which makes it more attractive to those who need immediate coverage. The Wellness Plan also provides additional benefits such as preventive care and access to a wide range of wellness programs. This makes it an ideal option for those who want to stay healthy and take proactive steps towards their well-being.

Cancellation Policy

If you decide to terminate the coverage for your pet, you need to submit written notice through either email, phone call, or mail.

If you cancel your policy within 30 days of its start date and haven’t made any successful claims, then the insurer will refund you the premium. Once the 30-day trial period has ended, ASPCA can refund any premiums that you paid for any remaining coverage periods after your last date of coverage.

Plan Exclusions

- The Companion Care plan has some typical exemptions that are commonly seen in the industry, including:

- Pre-existing conditions

- Cosmetic procedures

- Dental cleanings, root canals, crowns

- Breeding-related costs

- Boarding

- Anal sac (gland) expression and/or resection

- After-life care

- Intentional injuries

- Prescription food and vitamins used for preventive/general health purposes

Veterinary professionals should be aware that ASPCA Pet Insurance will not cover any costs if the vet performing or overseeing treatment is related to the policyholder in any way (eg. an employee, co-owner on the account, or a family member). This is important information for those looking to take advantage of the veterinary employee discount.

Pre-Existing Conditions

ASPCA pet insurance plans do not cover pre-existing conditions. If a pet has shown signs or symptoms of a condition before enrollment, or during the waiting period, it will be considered pre-existing.

However, a condition can be considered cured if the pet has gone 180 days without treatment or symptoms. Ligament and knee conditions are exceptions and will still be seen as pre-existing.

Plan Pricing

If you’re looking for pet insurance coverage, ASPCA Pet Insurance offers a variety of options to choose from. They have deductibles, annual limits, and reimbursement levels that can be tailored to fit your pet’s needs.

You can choose from plans with unlimited coverage amounts, though you will need to contact the company directly to get an exact quote. It’s also easy to enroll with ASPCA Pet Insurance, as you can do so either online or by telephone.

To sign up online, simply fill out the form on the website and provide the requested information. You’ll receive a quote detailing the available options and coverage levels.

Annual limits:

- $3,000

- $4,000

- $5,000

- $7,000

- $10,000

Annual deductible options:

- $100

- $250

- $500

Reimbursement options:

- 70%

- 80%

- 90%

Claims

The ASPCA offers multiple methods to submit claims; from using their customer portal or app to filling out an online form – both of which are available for both iOS and Android – to send in a claim via email, fax, or postal mail.

Utilizing the app will enable pet owners to easily keep track of the progress of their claims. Once processed, reimbursement is available via check or direct deposit into the customer’s account.

Customer Service

For any inquiries related to your ASPCA pet insurance policy, you can reach out to the company in multiple ways.

The customer service line is available Monday through Friday from 8 AM to 8 PM EST, at (866) 204-6764. You can also send an email to cservice@aspcapetinsurance.com, or make use of the contact form in the ASPCA app.

If you need assistance, the helpful customer service team will be happy to help.

ASPCA Pet Insurance provides comprehensive coverage for your pet’s medical needs, with coverage for cats, dogs, and horses. With a range of plans to choose from, including accident-only and add-on wellness coverage, you can pick the coverage that best fits your pet’s needs and budget.

You can also get a personalized quote, making it easy to compare options and prices. With no age limit for enrollment and 24/7 veterinary support, ASPCA Pet Insurance is dedicated to ensuring that your pet receives the best possible care.

Waiting periods vary and there are typical exclusions, such as pre-existing conditions and cosmetic procedures. Plans also have different deductibles, annual limits, and reimbursement levels.

ASPCA also offers multiple ways to submit claims and a helpful customer service team available by phone, email, or through the ASPCA app. Protect your pet with ASPCA Pet Insurance today.

5. Embrace Pet Insurance by Nerdwallet Recommendations

Founded in 2003, Embrace is a leading pet insurance provider for cats and dogs, used by renowned insurers like Allstate, Geico, and USAA for their customers. With their standard plan, you can get up to 90% of veterinary expenses reimbursed for a wide variety of treatments and conditions.

Customize the plan to fit your needs: choose your deductible, reimbursement amount, and annual limit, and enjoy the unique diminishing deductible feature that reduces the deductible by $50 each year you don’t file a claim.

Plus, with each policy sold, Embrace donates $2 to charitable organizations, so you can help animals in need. With Embrace, you can rest assured that your furry friends are taken care of.

Embrace the pros and cons

Embracing the pros and cons of life is a key element to being happy and successful. Taking life as it comes and recognizing that you will have both pleasant and unpleasant experiences can help you keep a positive attitude and stay focused on what matters.

It is important to remember that life has its ups and downs and that both are necessary to grow and become wiser.

An optimistic mindset will help you appreciate the good moments, while also having the strength to overcome the bad. Looking at the bigger picture and understanding that every experience is an opportunity to learn and improve is the best way to embrace the pros and cons of life.

Pros

- The deductible goes down each year you don’t make a claim.

- Many ways to customize your plan.

- The orthopedic waiting period can be reduced with a vet exam.

Cons

- Doesn’t cover prescription food or supplements.

Rating

Embrace Insurance has been awarded 5 out of 5 stars for its overall performance by NerdWallet. This rating is determined through a scoring formula created by the NerdWallet editorial team, which takes into account factors such as customer experience, coverage options, and financial strength ratings.

State availability

Pet owners all over the United States can now access Embrace Pet Insurance, which is available in all 50 states and Washington, D.C. This reliable and affordable pet insurance plan offers various levels of coverage to meet the needs of pet owners, no matter their budget or lifestyle.

Embrace pet insurance plans

Embrace offers several types of coverage to choose from.

Coverage for accidents and illnesses

Embrace Pet Insurance offers comprehensive coverage for most pets, with a policy that covers both accidents and illnesses. Members will receive reimbursement for vet bills that is a percentage of the total, up to their annual limit and after deducting their deductible. Pets aged 14 and under may enroll for life-long coverage for both accidents and illnesses.

Pets who start their policies at age 15 or older are eligible for accident-only coverage.

Wellness Rewards

With Wellness Rewards, you can save money on routine expenses like flea and tick prevention, vaccinations, and more without having to pay a copayment. This plan allows you to receive up to $250 worth of reimbursements every year, with an associated monthly premium of $18.25, or $225 for the year. However, it is important to note that if you fail to use the full $250 allowance in that year, you may end up paying more for the coverage than what you get out of it.

Wellness Rewards isn’t available in Rhode Island.

What Embrace pet insurance covers

The standard Embrace policy includes:

- Exams, treatment, hospitalization, and surgery for injuries and illnesses, including cancer.

- Diagnostic tests.

- Prescription medication.

- Hereditary conditions.

- Congenital conditions.

- Dental illnesses, including gingivitis, up to $1,000 a year.

- Complementary treatments such as acupuncture and laser therapy.

- Treatments are prescribed by veterinary specialists, such as behavioralists and oncologists.

Senior pet owners can opt for an accident-only plan, which covers scenarios like a cat swallowing a toy or a dog getting hit by a car. Bloat, a potentially life-threatening condition in which the stomach twists upon itself, is also covered by this policy.

In addition, prescription medications for treating accidents are covered in all states except New York. Though this plan does not cover illnesses, it provides a layer of protection against the financial hardship of unexpected pet emergencies.

The Wellness Rewards plan covers routine care, such as:

- Vaccinations.

- Spaying and neutering.

- Flea, tick, and heartworm preventives.

- Microchipping.

- Wellness exams.

- Grooming and nail clipping.

- Cremation or burial.

- Nutritional supplements and prescription diet food.

- Training.

- Preventive teeth cleaning.

What’s not covered

Embrace accident and illness insurance do not cover preexisting conditions, except for curable conditions that have not recurred in at least a year. This means that any illness, injury, or health condition that you had before the policy began will not be covered. Other conditions that are not covered include:

Embrace accident and illness insurance don’t cover:

- Preexisting conditions, except for curable conditions that haven’t recurred in at least a year.

- Expenses associated with breeding or pregnancy.

- Illness or injury due to fighting, racing or mistreatment.

- Cosmetic procedures.

- Wellness care.

- Prescription supplements or diets (unless you’ve added Wellness Rewards).

- The accident-only plan won’t cover the above or treatment for any illness.

Embrace coverage options

Deductibles: The annual deductible for the accident and illness policy can range from $200 to $1,000, while the accident-only policy has an annual deductible of $100. Each year that you don’t file a claim on either of these plans, your deductible will decrease by $50 and ultimately reach $0. If a claim is filed, your deductible will be reduced to the amount it was at before the claim was filed. The following year, the deductible will then reset to the original amount.

Reimbursement amounts: When it comes to the accident and illness policy, you have the option to receive a reimbursement of 70%, 80%, or 90% of your veterinary expenses. Alternatively, for the accident-only policy, you can choose to be reimbursed for up to 90% of your expenses. No matter what option you choose, you can rest assured that you are receiving the best coverage for your pet.

Coverage limits: The accident and illness policy offers annual coverage limits that range from $5,000 to $30,000, whereas the accident-only policy offers an annual limit of $5,000. This coverage is designed to help families with medical expenses if their pet becomes ill or injured. With these policies, pet owners can rest assured that their pet is receiving the best care possible and that any medical expenses will be covered.

Restrictions and waiting periods

Age restrictions: Pets can be enrolled in a policy as early as 6 weeks old. There is no maximum age limit, however, pets 15 and older will only be eligible for accident coverage and not accidental illness coverage. This ensures that both the pet and the policyholder get the most out of their coverage.

Waiting periods: When you purchase a policy from Embrace, there is a pre-established waiting period for different medical conditions, including 48 hours for accidents, 14 days for illnesses, and six months for orthopedic conditions for dogs.

You may be able to reduce your dog’s waiting period for orthopedic conditions to 14 days by taking them for an orthopedic exam. Additionally, there is no waiting period for routine care that is covered under Embrace’s Wellness Rewards.

All coverage for these conditions begins immediately upon purchasing a policy from Embrace.

Discounts

Embrace offers the following ways to save on pet insurance:

- 10% multiple pet discount.

- 5% military discount (not available in New York or Tennessee).

You can avoid a monthly billing fee by paying your annual premium in full, upfront.

Consumer experience

Website: The Embrace website makes it incredibly easy to access all the information you could need, from quick quotes to detailed coverage information. You can log in to the MyEmbrace portal to manage your policy, file and track claims, or add a new pet. Plus, if you ever need additional help, you can always contact their friendly customer support team. All this helps make Embrace one of the best pet insurance companies out there. With a simple and intuitive online experience, fast claims processing, and helpful customer support, Embrace is the perfect choice for anyone looking for quality pet insurance.

App: The Embrace mobile app has earned high marks for its ability to help users file and manage claims, check their coverage limits, update their policies, and even add a new pet. It’s user-friendly, reliable, and incredibly convenient. With the app, users can access their information and make changes easily, so they never have to worry about missing a payment or not getting the coverage they need. The app also has a sleek design, making it easy to navigate and use, regardless of experience. With Embrace mobile, users can stay up-to-date and in control of their policies.

Claims: Submitting a claim to Embrace is a straightforward process. You can do so online, through the app, or by mail, email, or fax. It usually takes 10-15 business days for Embrace to process the claim, but if you sign up for a direct deposit, you may receive payment sooner. To ensure the smoothest experience, make sure to provide all the required documentation and information at the time of submission.

Customer service: You can contact the customer service team at Embrace Monday to Friday by calling 800-511-9172. Alternatively, you can send an email or use the online chatbot for help with any pet-related questions. You can access their 24/7 PawSupport telemedicine service by logging into your online portal. This service provides round-the-clock assistance with any pet care queries you may have.